The oil market is one of the most volatile markets because of strong linkages to economic growth of several countries, vulnerability to geopolitical concerns, a strong cartel in the form of OPEC (and the ‘swing producer’ Saudi-Arabia), linkages to currency and equity markets and rampant speculation. Last week, oil price fell below $30/barrel (for the first time in the last 12 years), a psychological lower limit propounded by many analysts. While analysts start revising their forecasts, it is important to appreciate the causes (beyond the standard argument of the glut in the oil market pushing down the oil price) for the current nosedive in oil prices.

Iran is not a major reason

The conflict between Iran and Saudi Arabia has basically aggravated the situation with both countries now competing to sell oil at cheaper price. Although, sanctions on Iran selling oil have been lifted and Iran is expected to input 500k barrels of oil/day, this will have little impact on prices in coming days, given the move was largely anticipated. Something that might impact in the short run is if Iran begins selling oil at a discount to win clients. In the long run, what needs to be seen is whether Iran is able to attract foreign investments to revitalize ageing oil fields. The bottleneck here can be if big banks (funding source) would want to restart business with Iran, given the historical fines they have given for indulging in businesses with Iranian companies.

Some of the reasons that we have identified are as follows

- USD Appreciation – In a recent report stated by Morgan Stanley, the recent drop in oil price has more to do with US dollar appreciation rather than oversupply in the market. As USD appreciates it becomes more expensive for foreign countries to buy oil. As far as supply and demand is concerned, oversupply may have pushed oil prices to the range of $50-$60. After that it is mainly because of USD appreciation. A 3.2% appreciation of trade weighted USD may decrease the oil price by 6-15% or $2- $5 per barrel. (Important thing to note here is trade weighted USD that compares value of USD against certain currencies with weights depending on the amount of trade it does with a particular country. (click here to know more ). Hence, indirectly, a depreciation in CNY is driving an increase in USD. A 15% devaluation of yuan would boost trade weighted dollar by 3.2%. The below graph shows the correlation between the dollar index and oil price movement.

yellow line – Brent oil price/ white line – dollar index

USD has appreciated in the light of weak Chinese economy, strong US jobs data (where US added 292k jobs in December compared to expected 200k jobs) and unemployment data kept steady at 5%. Additionally, if other currencies depreciate the effect becomes compounded. On the contrary, although the Fed has said it is planning to increase interest rates 3-4 times in 2016, a rate increase late this month is highly unlikely owing to subdued inflation.

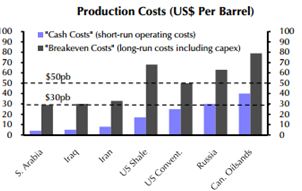

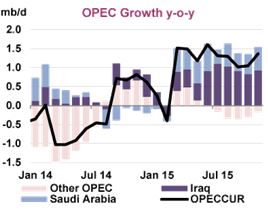

2. Production Costs – The following graphs shows estimates of short run costs and long run breakeven costs for major oil producing countries. At the current price of about $30 /barrel, the short run operating costs for major OPEC and US producers are covered. Hence, Saudi Arabia still has the leeway to push down prices to about $20/barrel, where it will make no economic sense for the US shale oil producers to continue pumping oil. Expecting oil prices to fall below $10/ barrel is unrealistic because it is not possible for Saudi Arabia to meet the entire global demand for oil. Hence, $20/ barrel is a reasonable lower bound for the volatile oil prices. hence, there is a lot of flurry in the market if $20 is going to be the threshold. One of the main reasons for Middle Eastern countries such as Saudi Arabia to not reduce production is that their market share is increasing at such low price levels. As in the graph below, the market share of middle eastern countries is increasing whereas that of the other countries is decreasing

.

3. Reduction in Surplus demand from China -With oil prices falling, China imported a record amount of crude. China’s crude imports last month (Dec’15) was equivalent to 7.85 million barrels a day, 6 percent higher than the previous record of 7.4 million in April, Bloomberg calculations show. China eased rules to allow private refiners, known as teapots, to import crude and boosted shipments to fill emergency stockpile. Now, this surplus demand from China has waned.

This data can be further validated by the fact that VLCC (very large crude container) rates have decreased as seen below. Initially, there was a surge in VLCC rates as China used to import a lot of oil because of low price.

\

\

4. Capacity Constraints -Another concern which is weighing on the oil market is the physical limit to the amount of oil that can be stored. As oil prices started falling in late 2014, oil producers began storing oil in tankers in the anticipation of a rebound in oil prices in the future. The following diagram shows the increasing stockpile of oil coupled with rising supply, despite a fall in prices. The graph goes on to predict the changes in global oil inventory until 3Q2017. The implication is that global oil inventory capacity is about to be breached by late 2016 and early 2017. Moreover, unless the oil producers stop pumping oil, the increase in the inventory (although at a diminished pace) will intensify downward pressure in oil price as this oil can’t be stored and needs to be sold in the open market.

Punit Parekh and Dinkar Mohta

All the views expressed are opinions of Networth – IIMB Finance Club – members. Networth declines any responsibility for eventual losses you may incur implementing all or part of the ideas contained in this website.

REFERENCES

http://www.zerohedge.com/news/2016-01-13/tanker-rates-tumble-last-pillar-strength-oil-market-crashes

http://www.bloomberg.com/news/articles/2016-01-11/morgan-stanley-sees-20-a-barrel-oil-on-u-s-dollar-appreciation